BEST BANK

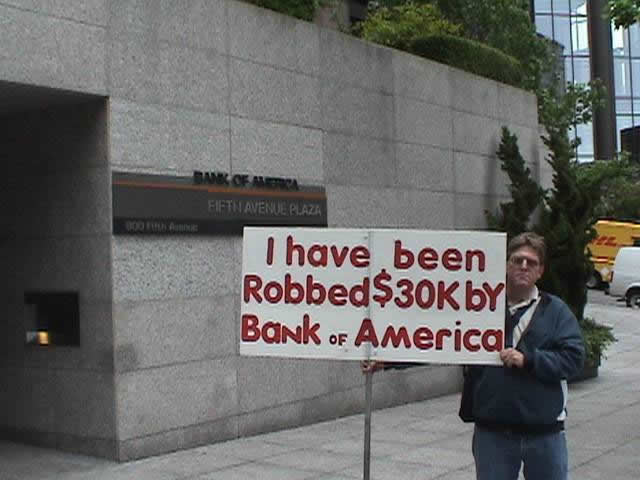

Do Not Bank at Bank of America

We have yet to find the best bank in and around Tustin, and await your input.But this page affords the opportunity to inform you of the bank with which you should never do business. I have no personal experience with Bank of America and hold no personal grudge. However, I receive at least one call a month from a potential client, wanting to sue Bank of America for removing funds from his or her account. There is something about the culture at Bank of America where the decisions made are always from a standpoint of "what can we do" instead of, "what should we do." When the decision is made to close an account, the funds are routinely removed with no notice to the customer, and disaster for the customer usually follows as all the outstanding checks are returned for insufficient funds, or perhaps worse, with a notation that the account is closed.

In one case, our client was on his way to work early one morning, when he received a frantic phone call from his bookkeeper. His business was cash intensive, and it was the practice of the bookkeeper to run a daily activity report at the beginning of each day. On this particular day, it was discovered that $50,000 was missing from his checking account. Our client called Bank of America to report what he thought must be a theft, only to learn that it was Bank of America that had closed his accounts and seized the funds.

When he asked why, he was told, "because we can, that's why." Since the account had been closed without notice, all the checks that had been written to customers and vendors failed to clear. In all, 12 checks were returned. On those checks Bank of America would stamp either "account closed" or "insufficient funds." In one of the worst cases of institutional arrogance I have ever seen, Bank of America charged escalating fees for each returned check, even though its own act had caused the problem. Then, for the coup de grâce, Bank of America took more than a week to return the money it had taken from the account, leaving the company without the funds necessary to deal with the disaster the bank had created.

The victim of this conduct asked only for an explanation and a letter of apology that he could show to his customers, but Bank of America refused.

When we became involved, Bank of America offered a number of excuses for its conduct, from computer errors to a claim that the accounts had been closed because of "suspicious activity." It was not until we sued and conducted discovery that we uncovered an internal document revealing the real reason Bank of America had taken the $50,000 without notice. Although it had never had any problems with our client, Bank of America had decided that our client's business was too check intensive, requiring too much work for the bank and potentially exposing the bank to losses. We never claimed that Bank of America had to maintain our client's accounts, but there was no reason Bank of America could not have provided advanced notice so our client could have closed the accounts in an orderly manner. We repeated our client's request for a letter of explanation, so that our client could undo some of the harm to his business reputation, but Bank of America still refused, steadfastly arguing that it had every right to act as it did. We were left with no option but to sue.

Bank of America took the position that Bank of America was permitted to close the accounts pursuant to its disclosure statement, and therefore whatever the motivation of Bank of America, and whatever harm Bank of America might have caused, we could not establish liability because Bank of America was permitted to do what it did. When opening a deposit account at Bank of America, the customer signs a

The victim of this conduct asked only for an explanation and a letter of apology that he could show to his customers, but Bank of America refused.

When we became involved, Bank of America offered a number of excuses for its conduct, from computer errors to a claim that the accounts had been closed because of "suspicious activity." It was not until we sued and conducted discovery that we uncovered an internal document revealing the real reason Bank of America had taken the $50,000 without notice. Although it had never had any problems with our client, Bank of America had decided that our client's business was too check intensive, requiring too much work for the bank and potentially exposing the bank to losses. We never claimed that Bank of America had to maintain our client's accounts, but there was no reason Bank of America could not have provided advanced notice so our client could have closed the accounts in an orderly manner. We repeated our client's request for a letter of explanation, so that our client could undo some of the harm to his business reputation, but Bank of America still refused, steadfastly arguing that it had every right to act as it did. We were left with no option but to sue.

Bank of America took the position that Bank of America was permitted to close the accounts pursuant to its disclosure statement, and therefore whatever the motivation of Bank of America, and whatever harm Bank of America might have caused, we could not establish liability because Bank of America was permitted to do what it did. When opening a deposit account at Bank of America, the customer signs a

signature card which also acts as an agreement between the customer and Bank of America. The signature card states "the written information we give you is part of this agreement and tells you the current terms of our deposit accounts" and that the agreement can be changed at any time. Although it is Bank of America's policy to provide the other "written information" whenever a customer opens an account, the new customer may or may not receive this other information, depending on whether the Bank of America employee remembers to provide a copy.

As a result, a new customer may enter into a contract with Bank of America, without ever having read the agreement or knowing its terms. Contained in the other, unnamed document is language which purports to give Bank of America the right to seize a customer's funds without cause and without warning.

Unfortunately for Bank of America, our client had never been provided a copy of this "other information" so it was not a part of the agreement. The jury was outraged by the conduct of Bank of America, and awarded our client $227,162 for 12 bounced checks. (This amount grew to $264,162 by the time we were done.) We successfully argued that Bank of America had harmed our client's business reputation by leading the check recipients to believe he had written bad checks, when in fact it was Bank of America's conduct that prevented the checks from clearing. The complete details can be found here.

For point of reference, while I receive at least one phone call per month from clients wanting to sue Bank of America for removing funds from their accounts, I have never received a similar call relating to any other bank. Unless you have some burning need to use the services of Bank of America, bank elsewhere.

-- Aaron Morris

March 29, 2009

Aaron Morris is a Partner with the law firm of Morris & Stone, LLP, located in Santa Ana, Orange County, California. He can be reached at (714) 954-0700, or by email. The practice areas of Morris & Stone include employment law (wrongful termination, sexual harassment, wage/overtime claims), business litigation (breach of contract, trade secret, partnership dissolution, unfair business practices, etc.), real estate and construction disputes, first amendment law, Internet law, discrimination claims, defamation suits, and legal malpractice.

Unfortunately for Bank of America, our client had never been provided a copy of this "other information" so it was not a part of the agreement. The jury was outraged by the conduct of Bank of America, and awarded our client $227,162 for 12 bounced checks. (This amount grew to $264,162 by the time we were done.) We successfully argued that Bank of America had harmed our client's business reputation by leading the check recipients to believe he had written bad checks, when in fact it was Bank of America's conduct that prevented the checks from clearing. The complete details can be found here.

For point of reference, while I receive at least one phone call per month from clients wanting to sue Bank of America for removing funds from their accounts, I have never received a similar call relating to any other bank. Unless you have some burning need to use the services of Bank of America, bank elsewhere.

-- Aaron Morris

March 29, 2009

Aaron Morris is a Partner with the law firm of Morris & Stone, LLP, located in Santa Ana, Orange County, California. He can be reached at (714) 954-0700, or by email. The practice areas of Morris & Stone include employment law (wrongful termination, sexual harassment, wage/overtime claims), business litigation (breach of contract, trade secret, partnership dissolution, unfair business practices, etc.), real estate and construction disputes, first amendment law, Internet law, discrimination claims, defamation suits, and legal malpractice.